Solana Mobile Unveils $SKR Tokenomics with 30% Airdrop to Seeker Users

What’s the moon math on $SKR’s potential valuation?

- Published:

- Edited:

It feels like just weeks ago that Solana Mobile delivered one of the year’s biggest announcements, unveiling the $SKR token that would grease the engine of the world’s first crypto-mobile economy.

Excitement towards $SKR has steadily grown since then, with over 100,000 Seeker devices being shipped out across the world to Solana’s most active and engaged users. Seeker Activity Tracking ramped up user enthusiasm ever higher, with the prospect of an $SKR airdrop incentivizing users to explore every corner of the Solana dApp Store.

With anticipation already at a fever pitch, Solana Mobile poured more fuel on the fire. Seeker’s tokenomics announcement is promising to distribute 30% of the $SKR supply directly to users in what could be one of Solana’s biggest airdrops ever.

Here’s everything you need to know about $SKR tokenomics, alongside a dash of optimistic moon math.

$SKR Tokenomics

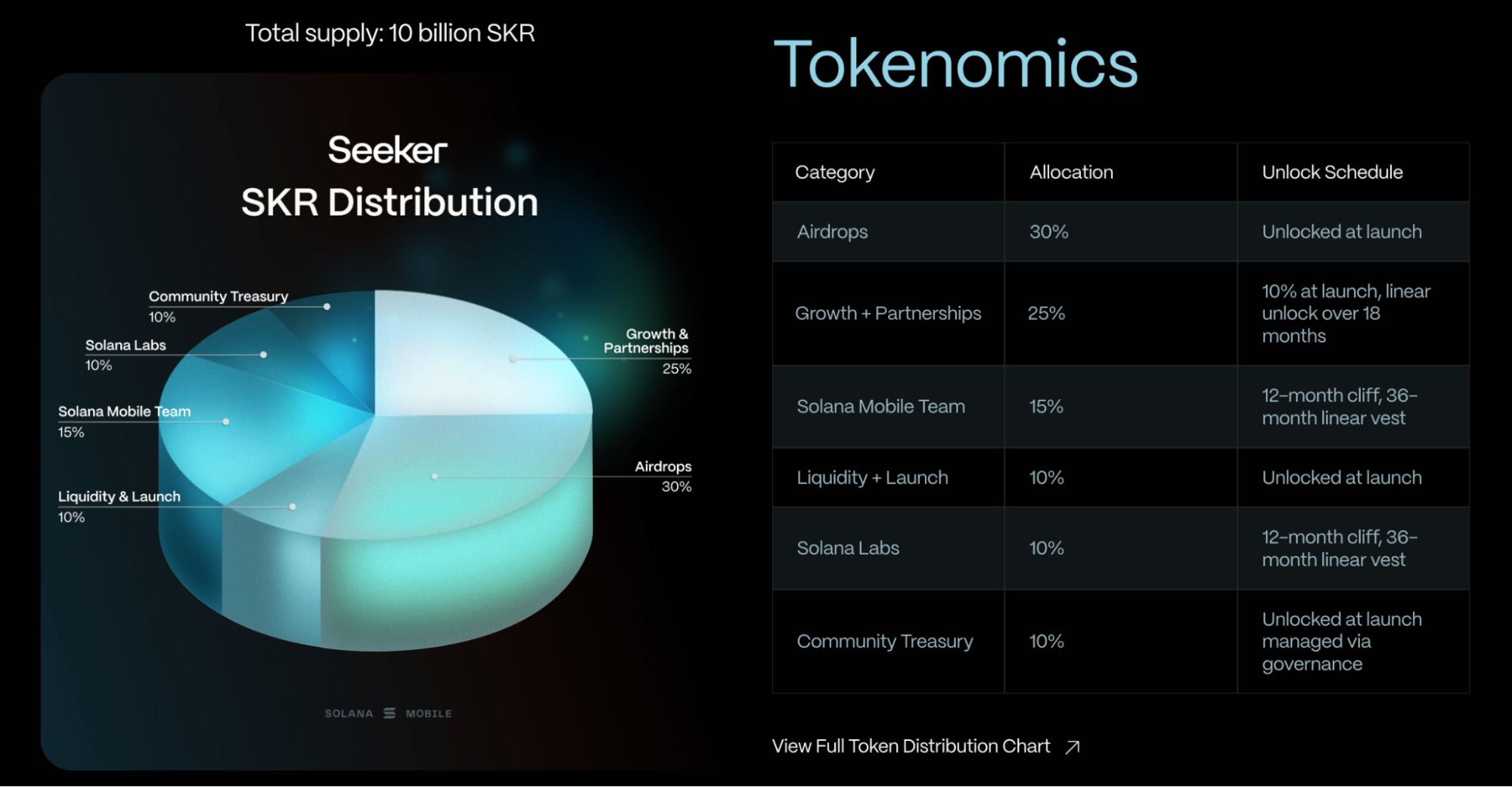

Solana Mobile has just revealed the full tokenomics for $SKR, the governance token of the Seeker economy and the second official token launched under the Solana Labs umbrella. While we don’t yet have a concrete launch day, the $SKR TGE is scheduled for sometime in January 2026.

$SKR distribution is relatively consistent with what we’ve come to expect from initial token allocations. Solana Mobile and Solana Labs will collectively receive 25% of the total supply. An additional 25% has been allocated to Growth & Partnerships, while Launch Liquidity and a Community Treasury will each receive 10%.

What stands out most dramatically amidst $SKR tokenomics is the whopping airdrop allocation. 30% of $SKR’s total supply will be distributed among Seeker users at TGE, suggesting that the $SKR drop could be the ecosystem’s biggest airdrop since $JUP launched in January 2024.

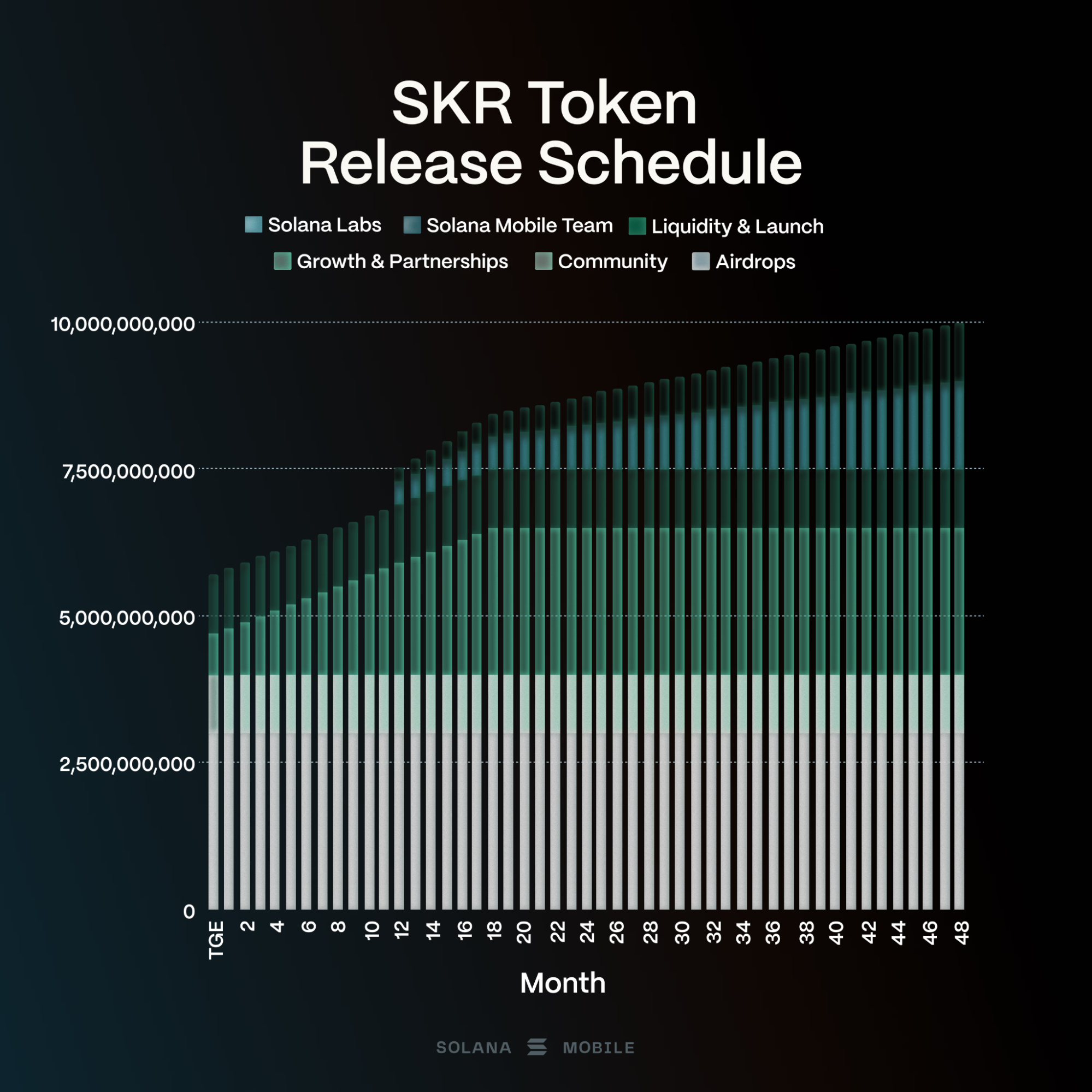

As illustrated by the $SKR vesting schedule, Solana Labs’ and Solana Mobile’s tokens are subject to a 1-year cliff and 3-year linear vest.

Airdrop allocations for Seeker users are expected to be based on each account's usage and activity. If you live under a rock and still haven’t minted your Seeker Genesis Token, there’s no better time than right now.

A Primer on $SKR Utility

$SKR is the lifeblood of the Seeker economy, an open mobile platform that seeks to disrupt the established Google x Apple duopoly and give users greater control, influence, and ownership of the crypto-mobile stack.

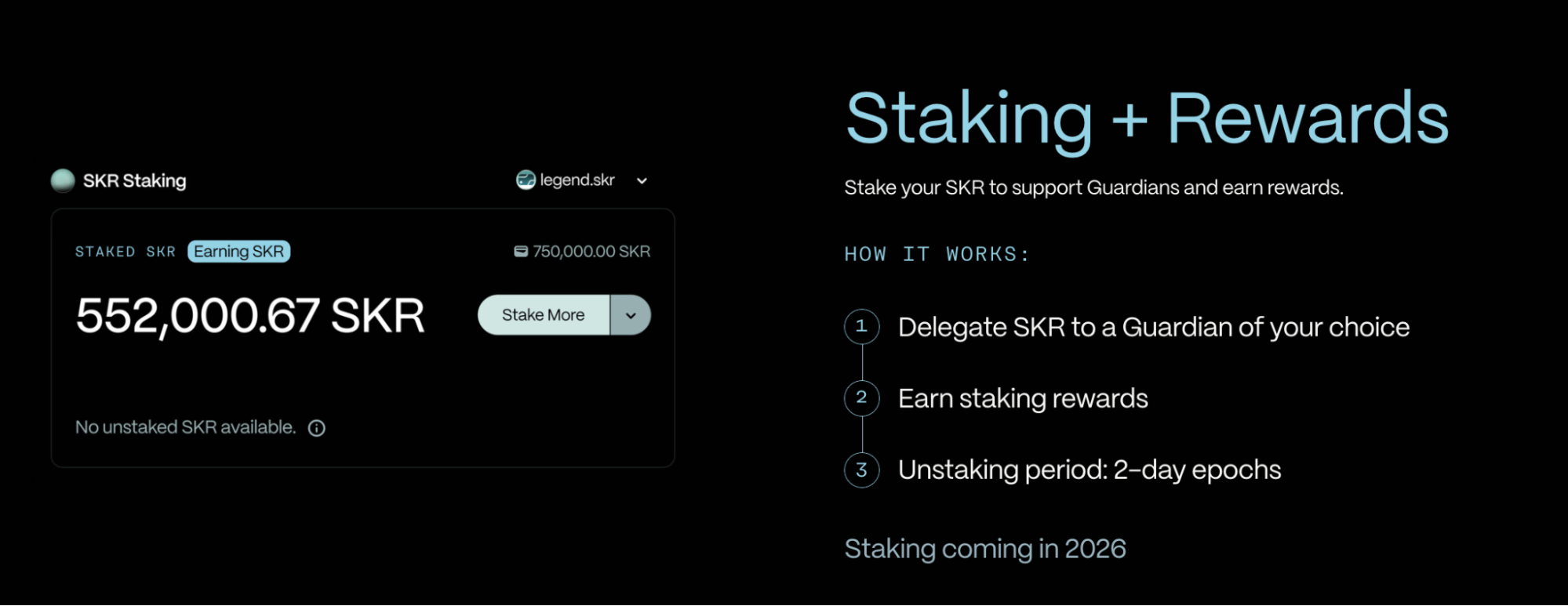

By holding and staking $SKR, Seeker users are empowered to govern, curate, and incentivize the developers, founders, and hardware manufacturers expanding the Seeker ecosystem.

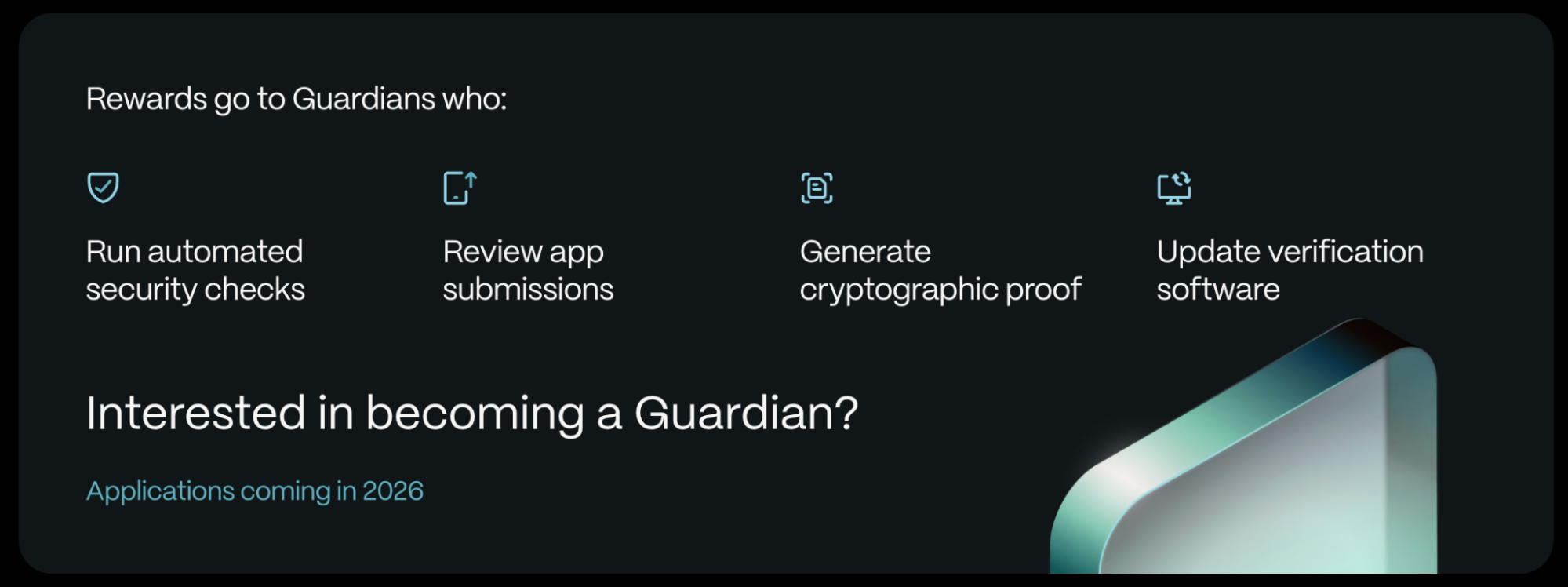

Alongside the tokenomics announcement, Solana Mobile has also announced the ecosystem's first Guardians. Comprised of Solana Ecosystem leaders, Seeker Guardians are responsible for verifying authenticity and maintaining standards of user integrity across the Seeker economy.

In 2026, Solana Mobile will be joined by Anza, DoubleZero, Triton, Helius, and Jito to form the first Guardian cohort. In much the same way that validators secure the Solana network, Guardians ensure the integrity of the Seeker ecosystem. $SKR holders can delegate their tokens with their preferred Guardians to earn ongoing rewards.

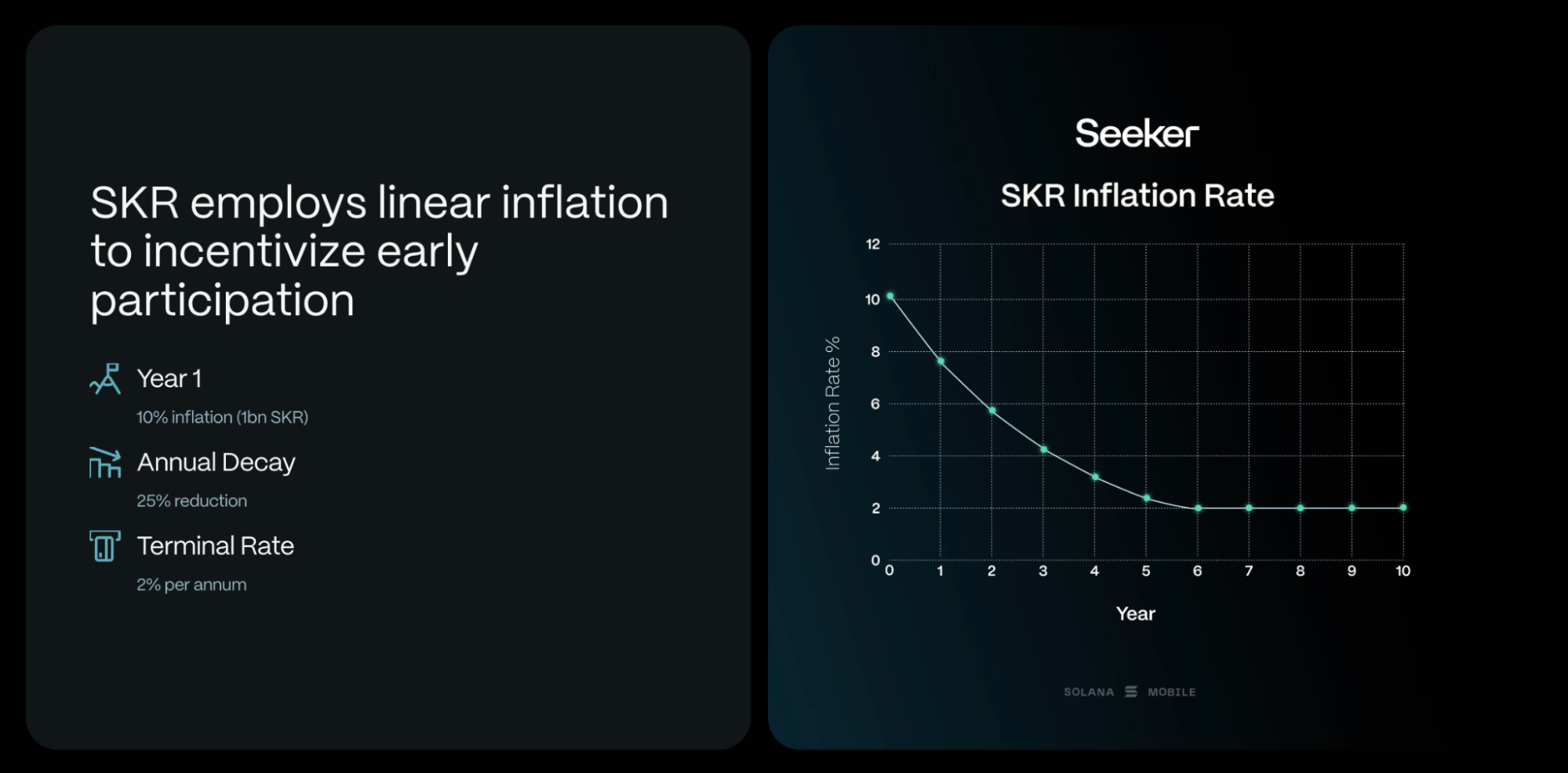

While the full breadth of what these rewards could entail is unconfirmed, stakers will likely earn additional $SKR tokens. According to Solana Mobile, $SKR inflation will start at 10% APY in Year 1, dropping by 25% per year until settling at a terminal inflation rate of 2% after six years.

What’s a Reasonable FDV for $SKR at Launch?

Dropping a staggering 30% of a token’s supply to users at TGE is almost unheard of in crypto, where most teams and protocols typically allocate 10-15% to their communities. Depending on $SKRs starting FDV, the Solana Mobile airdrop could represent a 9-fig liquidity event and handsomely repay Seeker users.

Speculating on a reasonable FDV for $SKR is no easy feat. Taking on the App Store duopoly, The Seeker Economy is undoubtedly one of crypto’s most ambitious experiments ever, making it difficult to compare it to any project or token that has come before it.

Solana Seeker can hardly be categorized into one sector alone. Yes, one could argue it's a DePIN device, but Seeker is also a wallet, an App Store, and an emerging TEEPIN stack the likes of which markets haven’t tried to value before.

Let’s make some standalone comparisons. Phantom, a leading crypto wallet, raised $150M at a $3B valuation in January 2025. At the time, Phantom reported 15M monthly active users. Over 150,000 people ordered the Solana Seeker, or 1% of Phantom’s MAU. Does that qualify the Seed Vault Wallet alone for a $30M FDV?

It's important to note that while Phantom is completely free, each Seeker owner has already paid $500 for their device and is more likely to be a Solana power user. Suppose each user performs an average swap volume of $10k per year via the Seed Vault Wallet (which charges a 0.08% fee), Solana Mobile generates a baseline annual revenue of $12M off $1.5B of trading volume.

But that’s just the tip of the proverbial iceberg. Seeker is also an authentic, high-value node for dozens of emerging Solana DePIN projects, like Grass, Natix, and Nosana. Other Mobile-centric DePIN protocols like Helium currently boast an FDV of $457M, despite making less in yearly revenue than what the Seed Vault Wallet could reasonably generate based on our above calculations.

Does that mean that we can expect to see $SKR’s FDV fall around a similar mark?

Maybe, but who really knows? The Seeker economy's value proposition is profoundly nuanced, combining a wealth of new paradigms that make hand-wavey comparisons admittedly obsolete. How do you value a 100,000-strong community of die-hard Solana users who are incentivized to test every app in the Solana dApp Store?

In the absence of a vague and ambiguous number plucked out of thin air to generate hype, let’s widen the lens. What is a 30% $SKR airdrop worth to the median user across both bearish and bullish scenarios?

If onchain activity is one of the main barometers of Seeker usage, what’s the potential difference between a Level 1 user, a median user, and a Level 5 user? The matrix below hypothesized the total dollar value of tokens that might go to each group, not accounting for “dApp Store” and “Daily Use” trackers.

|

$100m FDV ($0.01 per $SKR) |

$400m FDV ($0.04 per $SKR) |

$700m FDV ($0.07 per $SKR) |

$1b FDV ($0.10 per $SKR) |

$1.3b FDV($0.13 per $SKR) |

|

|

Level 1 (200m $SKR) |

$2M |

$8M |

$14M |

$20M |

$26M |

|

Level 2 (400m $SKR) |

$4M |

$16M |

$28M |

$40M |

$52M |

|

Level 3 (600m $SKR) |

$6M |

$24M |

$42M |

$60M |

$78M |

|

Level 4 (800m $SKR) |

$8M |

$32M |

$56M |

$80M |

$104M |

|

Level 5 (1b $SKR) |

$10M |

$40M |

$70M |

$100M |

$130M |

Moon math aside, it’s important to remember that the $SKR airdrop is not the endgame for the Seeker economy, but the beginning of the world’s first decentralized, open, and fair crypto mobile stack.

Beyond the initial 30% drop, there are still hundreds of millions of $SKR tokens earmarked for Growth, Partnerships, and the Community Treasury. Seeker users likely still have plenty of rewards and incentives to look forward to, as the $SKR expands beyond one device into the wider world of crypto hardware.

Read More on SolanaFloor

Vanguard is Bullish on Crypto?

Solana ETFs Record $45.7M in Daily Inflows as Vanguard Changes Stance on Crypto

How to Max Out Your Seeker Activity Tracker